di Justin Wolfer

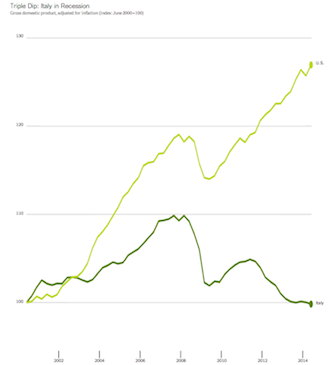

It’s not often that we’re moved to write about the Italian economy. But this morning’s news that it has shrunk for two quarters in a row — meeting a widely used threshold for the declaration of a recession — is worth noting. Italy has sunk into a triple-dip recession.

The downturn follows an incomplete recovery from the 2011 recession in the wake of the eurozone crisis, which in turn followed an incomplete recovery from the 2008 global financial crisis.

Take a good long look at that graph — a triple-dip recession is quite unusual. Each new recession has eclipsed the low in economic activity from the previous downturn. The result is that Italy’s current level of production is a whopping 9.1 percent below that in September 2007. Indeed, Italy is producing less today than it was in the middle of 2000.

By comparison, despite a weak expansion followed by a dreadful recession in the George W. Bush years, then a disappointing recovery under President Obama, the United States economy has grown 27 percent since June 2000. Even as many of us have been disappointed by the experience, it’s also worth acknowledging that our policy makers have gotten it less wrong than many others.

VIA/ The New York Times